Life Insurance in and around Frankfort

Protection for those you care about

Life won't wait. Neither should you.

Would you like to create a personalized life quote?

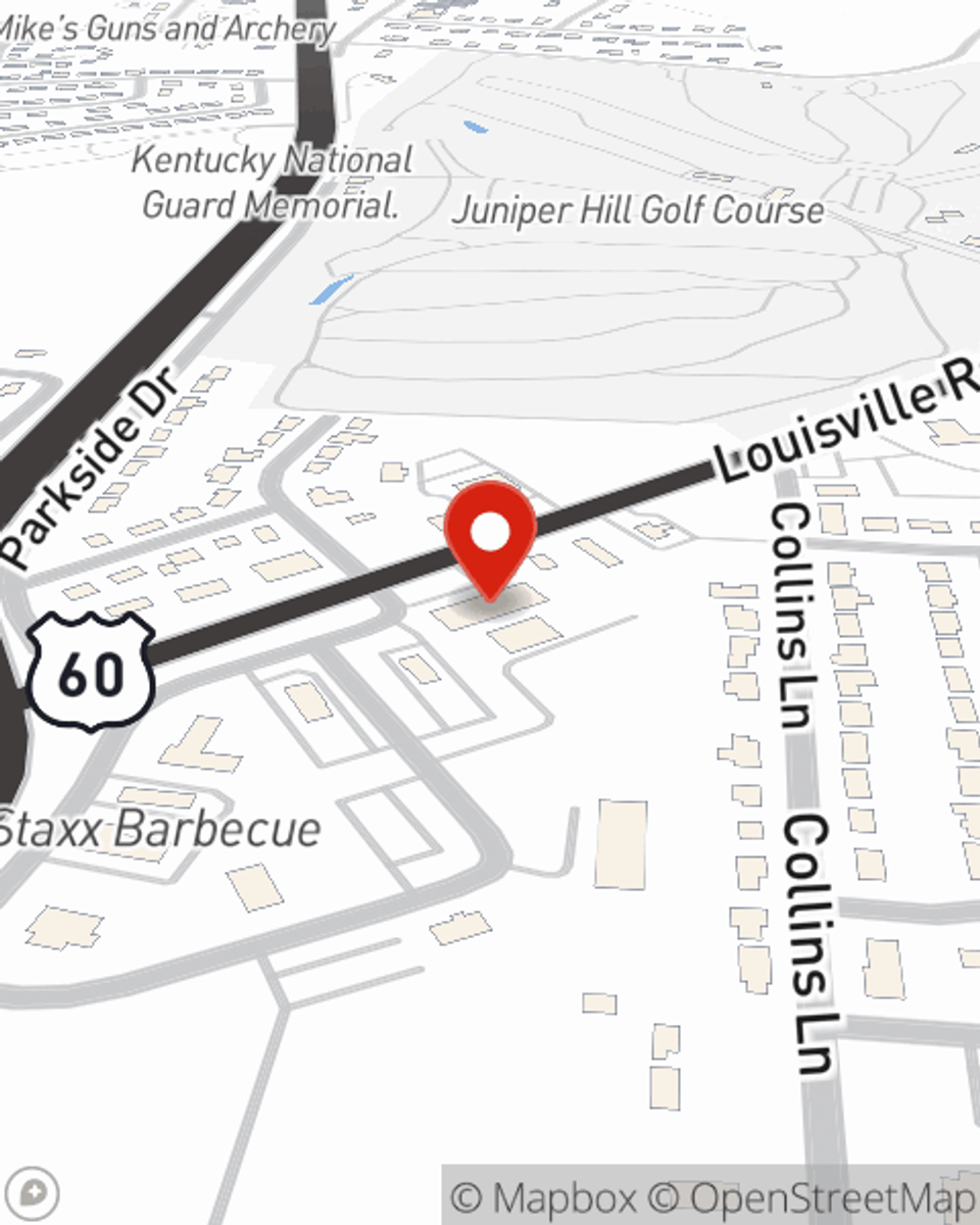

- Frankfort, KY

- Anderson County

- Fayette County

- Hardin County

- Jefferson County

- Scott County

- Woodford County

- Owen County

- Shelby County

- Louisville, KY

- Lexington, KY

- Georgetown, KY

- Shelbyville, KY

- Elizabethtown, KY

- Paris, KY

- Richmond, KY

- Lagrange, KY

- Oldham County

- Bowling Green, KY

- Warren County

- Covington, KY

Check Out Life Insurance Options With State Farm

If you are young and newly married, it's the perfect time to talk with State Farm Agent RB Brown about life insurance. That's because once you start building a life, you'll want to be ready if your days are cut short.

Protection for those you care about

Life won't wait. Neither should you.

Life Insurance Options To Fit Your Needs

Life can be just as unpredictable when you're young as when you get older. That's why now could be a good time to get Life insurance and why State Farm offers multiple coverage options. Whether you're looking for level or flexible payments with coverage to last a lifetime or coverage for a specific number of years, State Farm can help you choose the right policy for you.

Regardless of where you're at in life, you're still a person who could need life insurance. Call or email State Farm agent RB Brown's office to search for the options that are right for you and your loved ones.

Have More Questions About Life Insurance?

Call RB at (502) 875-1301 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Benefits of owning a life insurance policy to cover your final expenses

Benefits of owning a life insurance policy to cover your final expenses

Final expense insurance (or burial insurance) can help relieve the burden of funeral planning. We'll explore details of guaranteed issue life insurance.

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.

Simple Insights®

Benefits of owning a life insurance policy to cover your final expenses

Benefits of owning a life insurance policy to cover your final expenses

Final expense insurance (or burial insurance) can help relieve the burden of funeral planning. We'll explore details of guaranteed issue life insurance.

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.